Do you know your credit score? More importantly, why does it matter? Put simply, a variety of financial businesses use your credit score as an indicator to predict the likelihood you’ll pay them back. The higher your credit score, the more likely you’ll be able to obtain credit and pay less interest, which can save you significant amounts of money.

What Is a FICO® Score, and Why Should You Care?

Your FICO® Score is based on the data calculated by the three main credit reporting bureaus: Equifax, Experian, and TransUnion. Your FICO® Score summarizes this data and shares it in a score (300-850; the higher your score, the better). It measures how long you’ve had credit (your credit history), how much credit you currently have, how much of your credit you’re using, and if you have a history of making payments on time. Your FICO® Score isn’t static. It can go up or down based on how you manage your credit. If you fail to make payments on time, your score will decrease. Reduce the amount of credit you’re using, and your score will likely increase. While bank and credit union accounts do not show up on your credit score, they may ask for this information when assessing a loan or credit application.

Learn Your Credit Score for Free

Getting your credit score for free every month is easy using our new Credit Score Tool in Tulee, our digital banking platform. Checking your score in Tulee has no impact on your credit report. If you haven’t signed up for Tulee, do so today. Keep reading to learn the benefits of knowing your credit score and how to use our new Credit Score Tool in Tulee.

5 Reasons You Need to Know Your Credit Score

- Financial health awareness: Your credit score reflects your financial health. It gives you a snapshot of how lenders view you as a borrower. Knowing your credit score enables you to gauge your financial standing and take steps to improve it if needed.

- Access to credit: Many lenders, including banks, credit unions, and credit card companies, use your credit score to determine whether to approve your loan or credit card application. The higher your credit score, the better your chances of being approved for loans and credit cards with better terms, such as lower interest rates, which can save you a significant amount of money, and higher credit limits give you greater financial flexibility.

- Interest rates: Your credit score influences your interest rates on loans and credit cards. A higher credit score typically qualifies you for lower interest rates, saving you money on interest payments. Conversely, a lower credit score may result in higher interest rates, costing you more money in the long run.

- Rental applications: Landlords and property management companies often check credit scores as part of the rental application process. A good credit score can increase your chances of securing an apartment or home rental, while a poor credit score may make it more challenging to find housing or require a larger security deposit.

- Employment opportunities: In some cases, employers may review your credit score as part of their hiring process, especially for positions that involve financial responsibilities. While the practice is controversial and less common than credit checks for loans or rentals, having a good credit score can still be beneficial when applying for a job.

How to Use Our New Credit Score Tool

Now that you understand the value of knowing your credit score, we’ll show you how to get your score for free each month using our new Credit Score Tool in Tulee. Remember, there’s no impact on your credit report.

Step 1: Begin by logging in to Tulee.

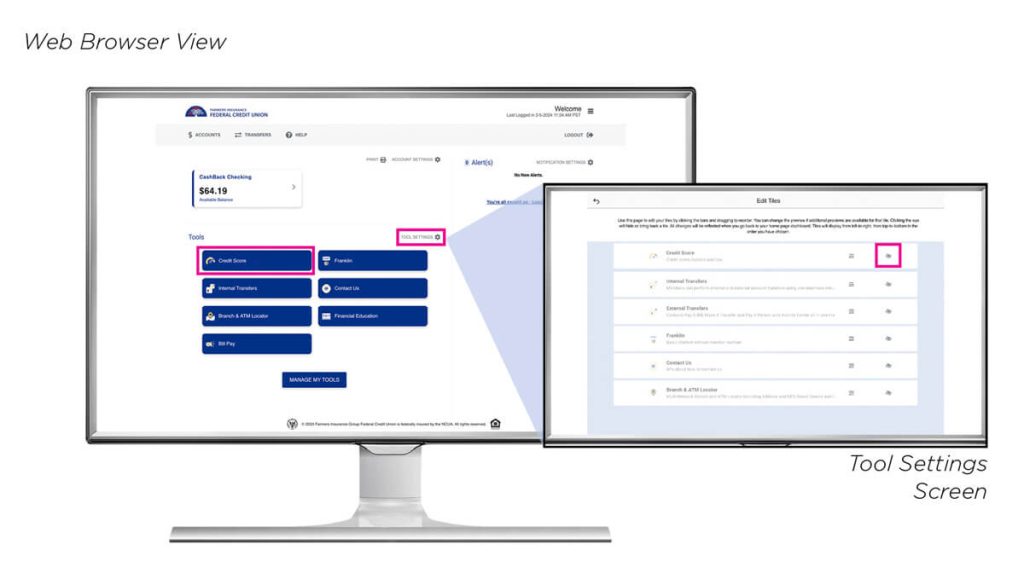

Step 2: After you log in to Tulee, the home page lists all the available tools. Click the Credit Score Tool.

If the Credit Score Tool isn’t listed, click the Tool Settings Screen. Then click the grayed-out eyeball to add the Credit Score Tool to the home screen. Please note, that the Credit Score Tool is unavailable for Organization accounts (Businesses and trusts).

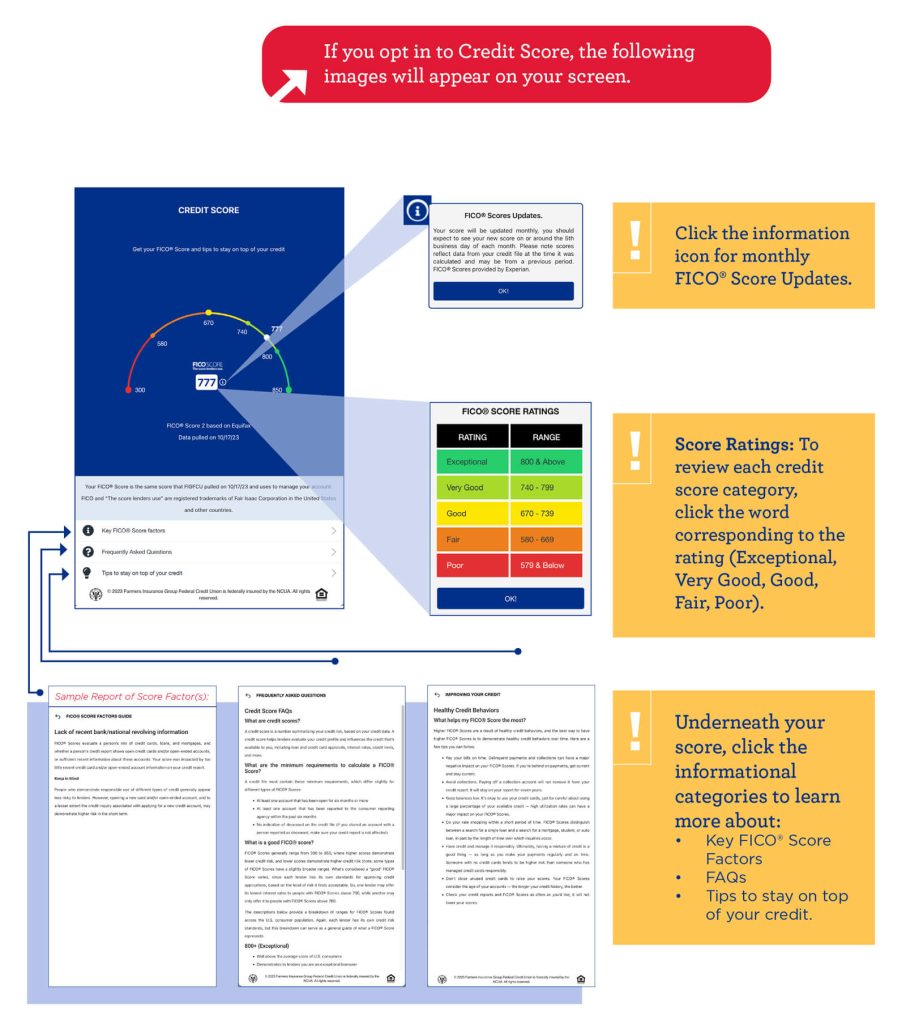

Step 3: Once you’ve opened the Credit Score Tool, your FICO® Score will appear on the screen if you’ve previously opted in for this service. If you haven’t opted in, we’ll cover how to do so in the next section. Please review the sections in the graphic above to learn more about your Score Rating and additional information that will help you understand your score.

How to Opt In

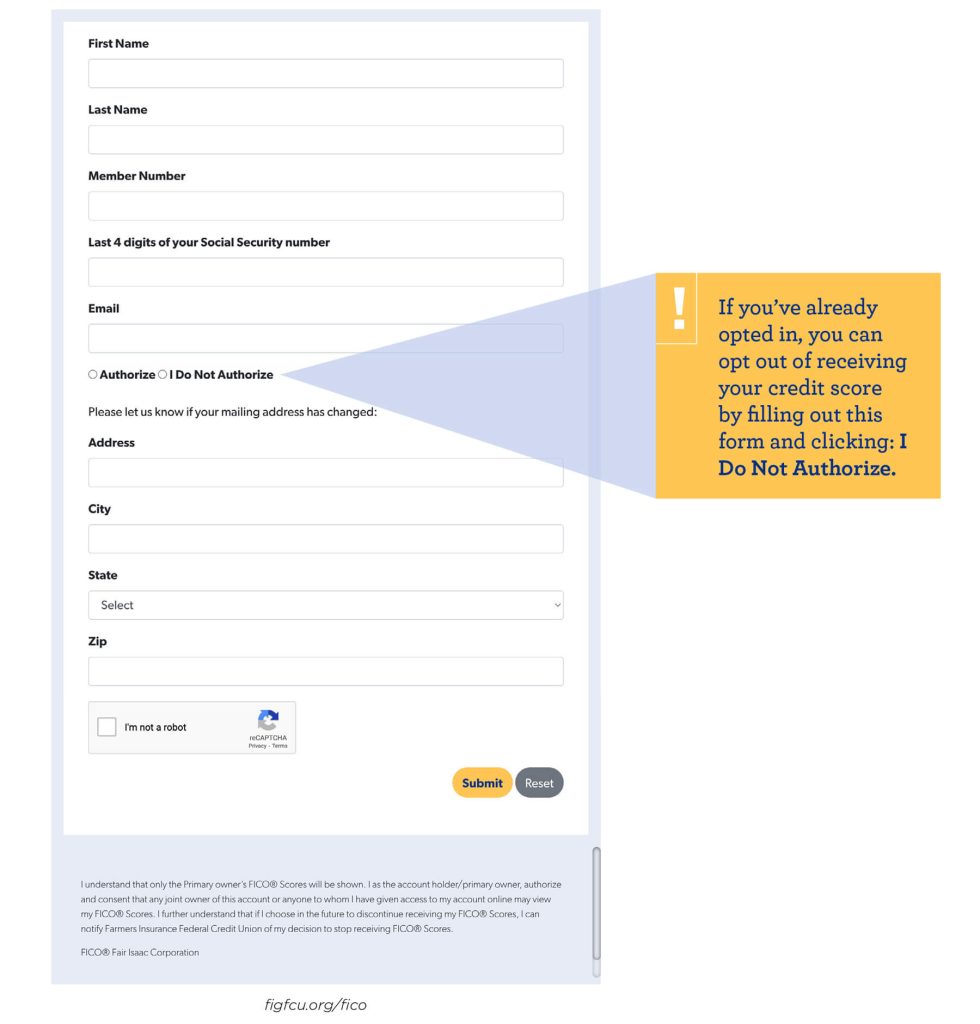

If you haven’t previously opted in, click Opt In to view your FICO® Score button to begin the opt-in process on our website.

Fill out the opt-in form and click the Submit button at the bottom of the page. Once you’ve opted in, you will see your score in Tulee at the beginning of the following month.

Final Thoughts

Knowing your credit score is crucial for understanding your financial health, accessing credit on favorable terms, and securing rental housing. Your score may also impact employment opportunities. Checking your credit score every month helps you identify any yellow flags that may indicate outside fraud and inaccuracies that you can take steps to correct and maintain or improve your score. For more information on our new Credit Score Tool and how to use it, play the How Tulee video or download the infographic now.